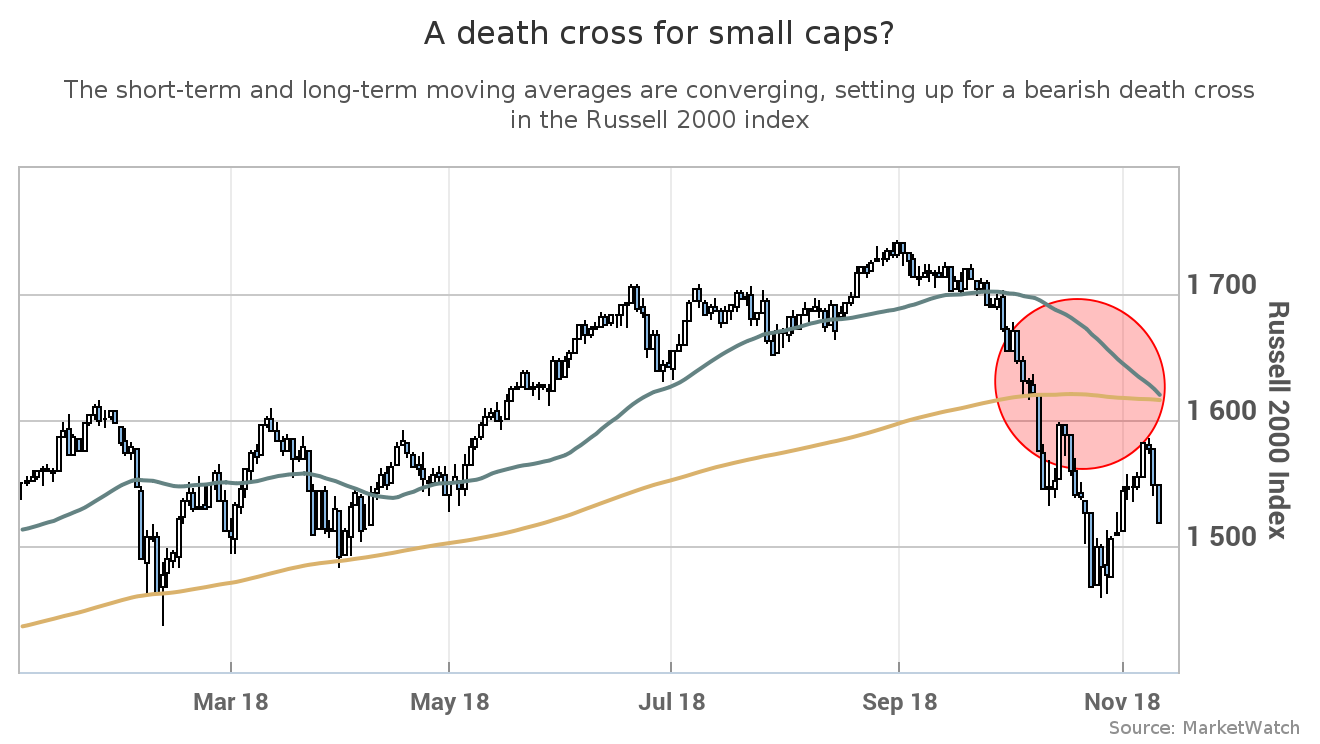

A closely followed gauge of small-capitalization stocks is a hair’s breadth from realizing a bearish pattern.

On Tuesday, the small-cap Russell 2000 index RUT, +0.24% was less than a point of seeing its short-term 50-day moving average fall beneath its long-term 200-day moving average, a formation in an asset that many chart watchers believe marks the point that a short-term decline morphs into a longer-term downtrend (see chart attached).

According to FactSet data, as of Monday’s close, the Russell’s 50-day moving average is at 1,615.69, while the 200-day stands at 1,615.48, as of Nov. 9. Last Friday, MarketWatch reported that the death cross could play out as earlier as this week, given a steady decline in the index. Monday’s sharp, broad-market selloff certainly contributed to the downtrend.

Shares of smaller companies had climbed more than their larger counterparts because they were viewed as more resilient amid growing concerns about the U.S.’s trade spat with China. Small-cap companies derive the lion’s share of their revenues domestically.

Investors piling in to the Russell 2000 drove the index to a 52-week high of 1,740.75 on Aug. 31. The benchmark is now 12.8% below that recent high.

The Russell hasn’t been as resilient to recent pains as it in earlier weeks. Its latest decline comes amid heightened concerns about the pace of rate increases by the Federal Reserve and the strength of the global economy. These are factors hitting the broader market.

On Monday, the Russell closed down about 2% at 1,518.79, the Dow Jones Industrial Average DJIA, -0.38% finished down 602 points and the large-cap S&P 500 index SPX, +0.19% also sank, with those indexes coming off an ugly October period that drove the Nasdaq Composite Index COMP, +0.57% into correction territory for the first time in two years and briefly erased year-to-date gains for the other main benchmarks.

For the year, the Russell 2000 is down 1.1%, while the Dow is set for a year-to-date advance of 2.7%, the S&P 500 is on pace for a yearly gain of 2% and the Nasdaq is poised for a return of 4.3% over the past 11 months.

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.