Author: super@dmin

-

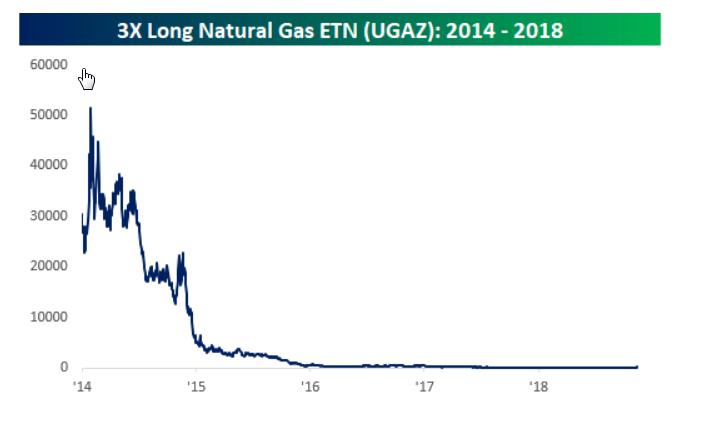

In One Chart: How a 200% surge in a triple-leveraged natural-gas ETN can be a cautionary tale

Gas futures are surging. But the value of a triple-leveraged exchange-traded note is seeing a parabolic move, and drawing some attention on Wall Street. The VelocityShares 3x Long Natural Gas ETN UGAZ, +32.51% which is pegged to the S&P GSCI Natural Gas Index Excess Return SPGSNGP, +10.49% has returned 77% so far this week, pushing…

-

Outside the Box: Everything you need to know about how your 401(k) works

You’ve probably heard the term 401(k) at least a thousand times, and you might even have some of your own money invested in one. But exactly what is a 401(k)? And how does a 401(k) work? Those are the questions I’m going to answer. And I’m going to answer them in plain English, so by…

-

Outside the Box: Why early retirement is all it’s cracked up to be

Sometimes, the stuff that people say about early retirement (and early retirees) is terrible. It is assumed that early retirement is the end of productive life and that unless we’re swimming in millions in cold hard cash, early retirement will eat us alive. Today, it is my distinct honor and pleasure to debunk five of…

-

Currencies: British pound softens as May attempts to push controversial Brexit deal

The British pound softened versus the dollar and other rivals Wednesday as investors assess the likelihood U.K. Prime Minister Theresa May will be able to win approval of a draft Brexit deal in the face of heavy skepticism from members of her own government. The pound GBPUSD, -0.1465% traded at $1.2941 versus the dollar, down…

-

CryptoWatch: Bitcoin slides to one-month low

Bitcoin traded lower Wednesday, on track for a third consecutive losing session. In midmorning trade, a single bitcoin BTCUSD, -1.35% was fetching $6,261.36, down 1.1% since Tuesday at 5 p.m. Eastern Time on the Kraken crypto exchange. Earlier in the session, bitcoin traded to $6,211.84, marking its lowest level since Oct. 15. Despite gravitating away…

-

Metals Stocks: Gold prices pause the downdraft as inflation data, dollar action in focus

Gold prices were pinned near unchanged levels Wednesday, a pause in selling action that had driven the metal down for seven sessions in the past eight. December gold GCZ8, +0.00% changed hands at $1,201.40 an ounce. The finish at this level Tuesday marked the lowest for a most-active contract since Oct. 10, according to FactSet…

-

Futures Movers: Oil prices try to steady after 12th straight drop

U.S. oil prices wavered early Wednesday as investors continued to wrestle with rising crude supplies against lingering questions about demand. West Texas Intermediate oil for December delivery CLZ8, +0.99% rose 23 cents, or 0.4%, at $55.91 a barrel, after settling Tuesday at $55.69 on the New York Mercantile Exchange. That was the lowest front-month contract…

-

Bond Report: Treasury yields edge lower ahead of key inflation data

Treasury yields fell slightly on early Tuesday trading ahead of October’s consumer prices data, a potential pivot point for investors who hold the Federal Reserve’s steady rate hikes responsible for the bond market’s selloff this year. The 10-year Treasury note yield TMUBMUSD10Y, +0.44% was down 0.7 basis point to 3.138%. The 2-year note yield TMUBMUSD02Y,…

-

Market Snapshot: Dow poised for longest skid in 3 months as stock market set to extend slide

The Dow on Wednesday is attempting to avoid its longest string of losses since mid August, as oil volatility has dented sentiment, and as investors await a key reading of consumer inflation. How are the benchmarks faring? Futures for the Dow Jones Industrial Average YMZ8, +0.44% fell 16 points to 25,320—a fourth consecutive loss for…

-

Outside the Box: These U.S. states are putting their bond investors in a world of hurt

Investors in state bonds, beware. Four U.S. states — Illinois, New Jersey, Hawaii, and Connecticut — are sitting on time bombs. Between 35% and 51% of their annual revenues are likely to be needed to meet their total annual payment obligations on existing debt, retirement plans, and retiree healthcare. Yet the general obligation (GO) bonds…