Author: super@dmin

-

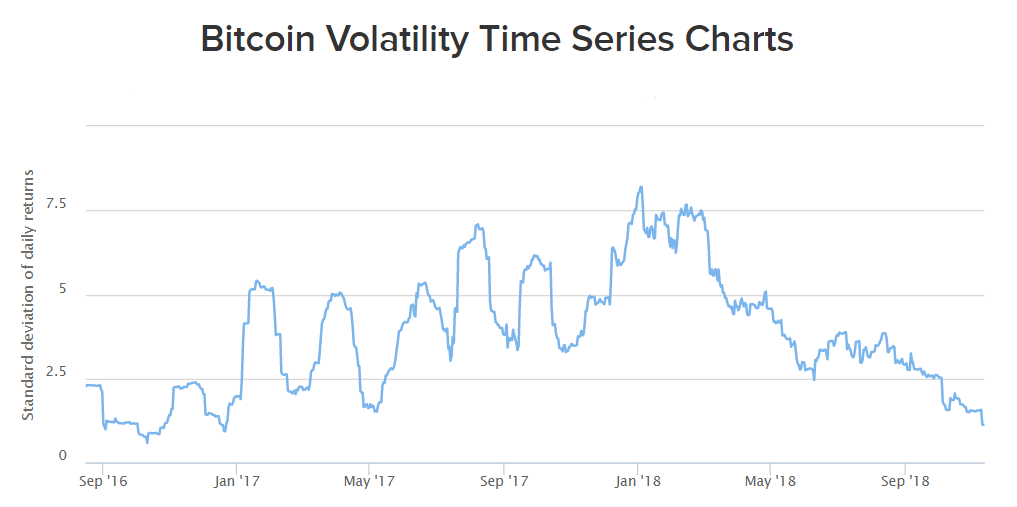

CryptoWatch: A measure of bitcoin volatility fell to its lowest level since 2016

Bitcoin prices are mostly unchanged Tuesday, extending the recent lull in price activity that has pushed a popular gauge of volatility to its lowest level in almost two years. One measure of bitcoin’s volatility in the prior 30-day period marked its lowest level since December 2016, as the world’s largest cryptocurrency remains pegged either side…

-

Key Words: Founder of hedge fund giant says Trump’s Fed attack threatens ‘confidence people have’ in the dollar

‘The concept that our central bank is independent from partisan politics is extraordinarily important to the stature of our currency in global markets and to the faith and confidence people have in the value of the dollar both domestically and abroad.’ —Kenneth Griffin Those are the thoughts of Ken Griffin, the founder of Chicago-based Citadel…

-

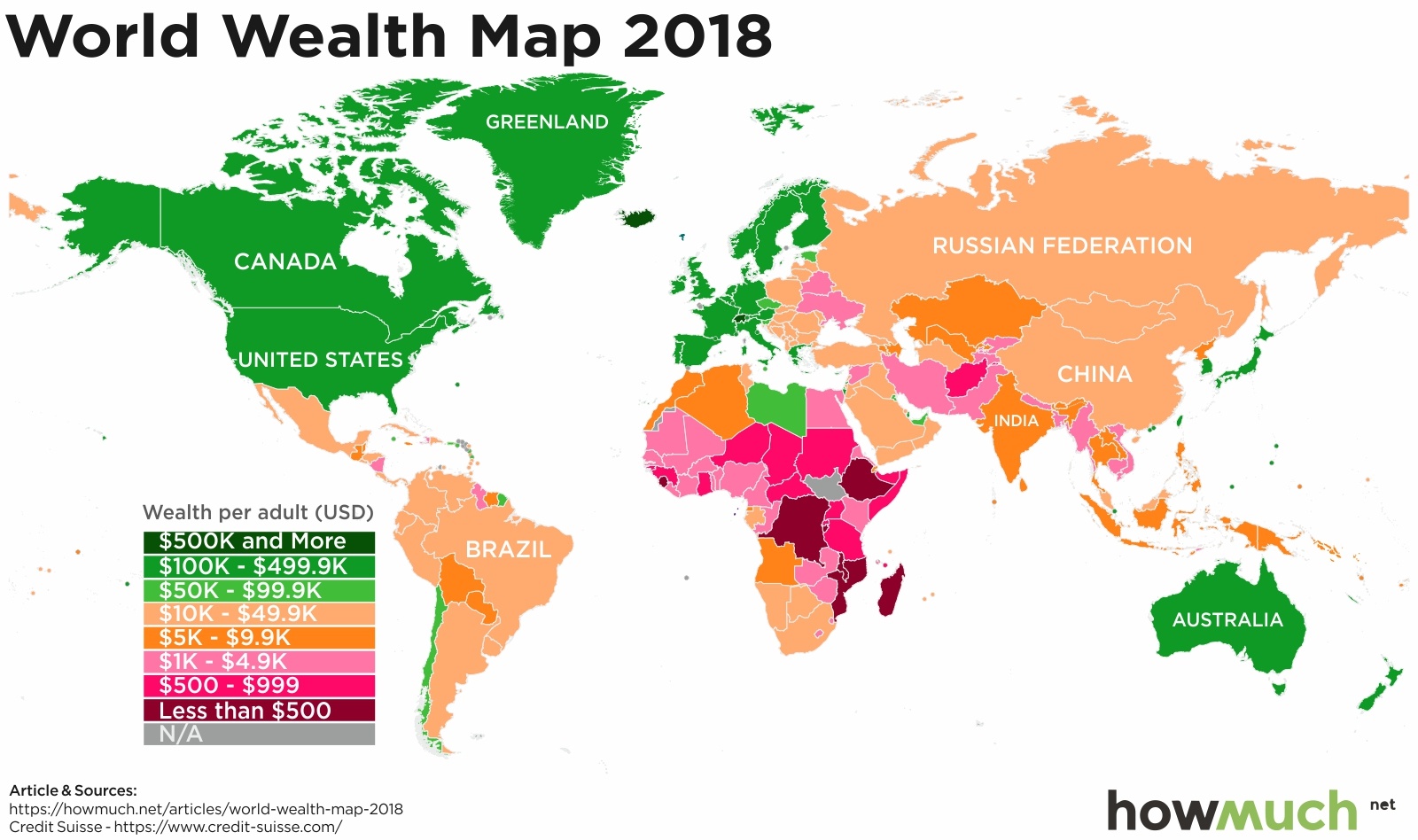

This map shows where the wealthy — and not so wealthy — of the world live

If you need to see just how much wealth inequality exists across the globe, look no further. Source: Credit Suisse and HowMuch.net The Credit Suisse Research Institute, a think tank within the Swiss investment bank Credit Suisse, in October published its annual global wealth report. That report estimates the wealth holdings of households around the…

-

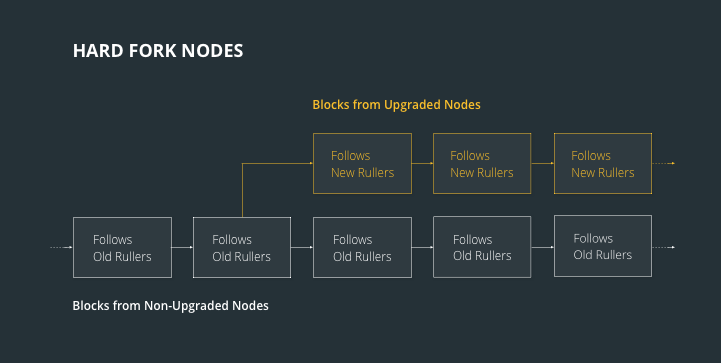

CryptoWatch: What you need to know about the Bitcoin Cash ‘hard fork’

On Thursday, Bitcoin Cash, perhaps, the most famous hard fork of bitcoin and the fourth-largest cryptocurrency, will split in two, creating a second cryptocurrency. The two digital currencies will go by the names Bitcoin ABC (core Bitcoin Cash) and Bitcoin SV (Satoshi’s Vision). A hard fork is when developers and miners no longer agree on…

-

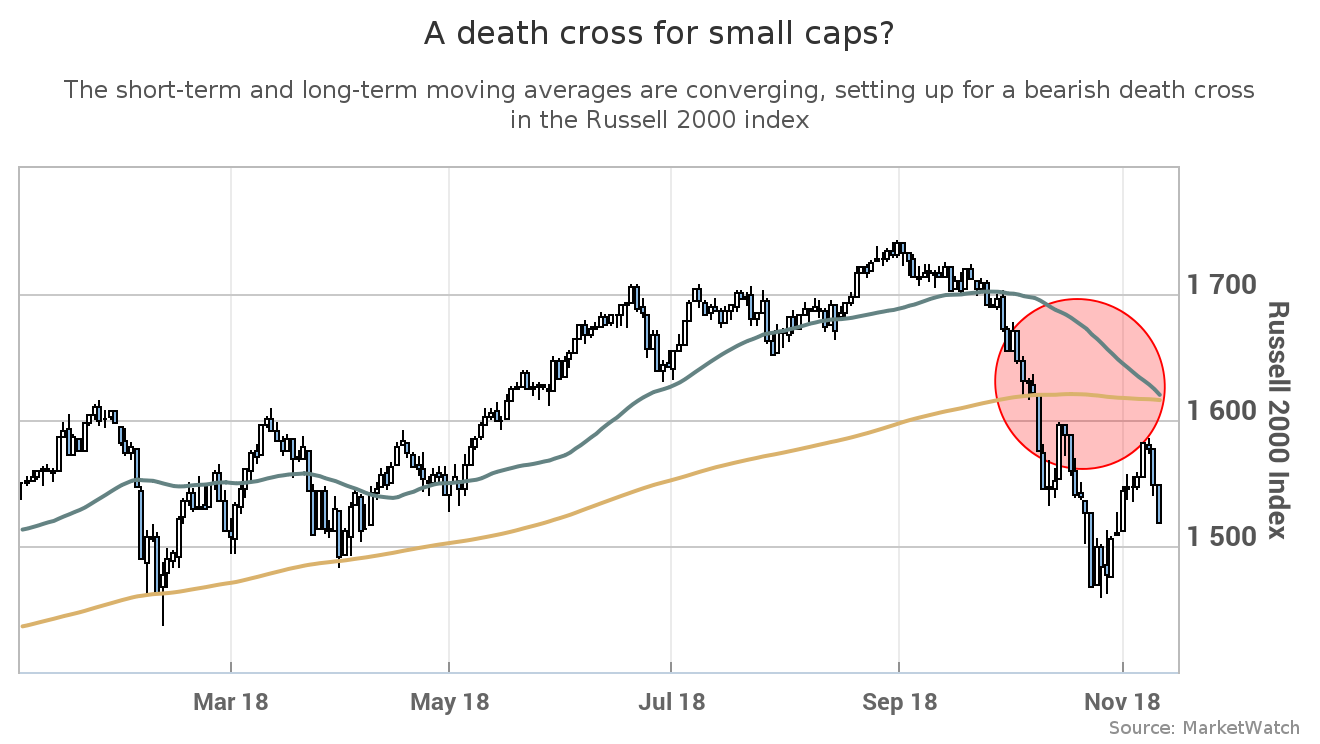

Market Extra: Small-cap index perilously close to death cross — and that’s bad news for the broader stock market

A closely followed gauge of small-capitalization stocks is a hair’s breadth from realizing a bearish pattern. On Tuesday, the small-cap Russell 2000 index RUT, +0.24% was less than a point of seeing its short-term 50-day moving average fall beneath its long-term 200-day moving average, a formation in an asset that many chart watchers believe marks…

-

Outside the Box: These two stock-chart patterns show that bulls and bears are at loggerheads

The stock market is developing two chart patterns that all prudent investors should pay attention to. Let’s explore the issue with the help of a chart. Please click here for an annotated chart of S&P 500 ETF SPY, +0.12% Somewhat similar conclusions can be drawn from charts of the Dow Jones Industrial Average DJIA, -0.39%…

-

Market Snapshot: Stocks stage cautious rebound, but Dow’s gains capped by Home Depot, Boeing

U.S. stocks attempted to trade higher Tuesday, a day after the Dow and the technology-laden Nasdaq suffered triple-digit losses, amid gyrations in the oil market, a stronger dollar and nagging concerns about trade negotiations and sluggish international growth. How did the benchmarks fare? The Dow Jones Industrial Average DJIA, -0.40% fell 20 points, or less…

-

Metals Stocks: Gold struggles to halt lengthy losing streak even as dollar index pulls back

Gold prices mostly tipped lower Tuesday, at risk of logging a fourth straight decline and the seventh down day out of the past eight, as a popular gauge of the dollar slipped but remained near its highest level in roughly 17 months. December gold GCZ8, -0.12% slipped 10 cents, or 0.1%, at $1,203.40 an ounce,…

-

Currencies: Euro, sterling reverse Monday’s slump, dollar slips

European rivals of the U.S. dollar rebounded on Tuesday, bouncing back after a sharp sell-off on Monday inspired by worries about Italy’s budget proposal and tensions with the European Commission, as well as Brexit. Having faced its weakest level since June 2017, the euro EURUSD, +0.3833% strengthened against the dollar on Tuesday, last buying $1.1249,…

-

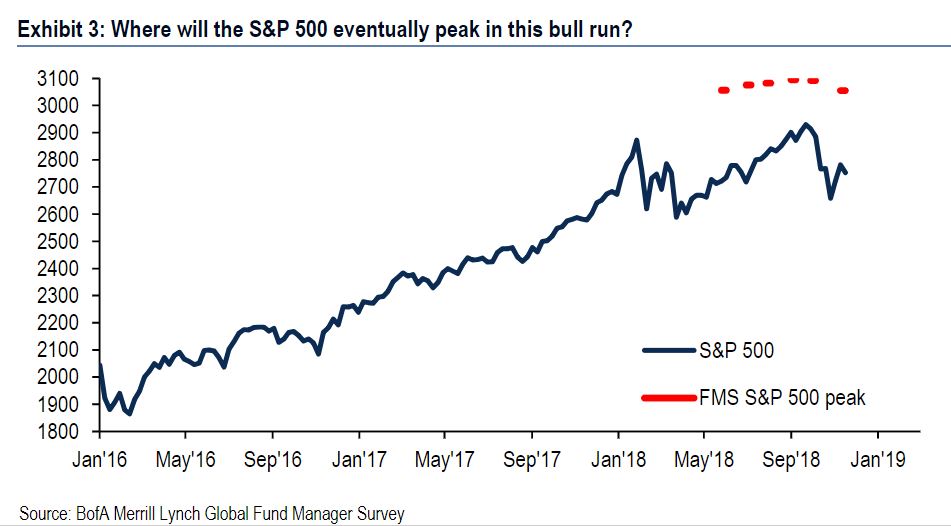

Need to Know: Stay bearish because the ‘Big Low’ for stocks hasn’t arrived yet, says Bank of America

For investors, it may be a case of nowhere to run, nowhere to hide. So says CNBC’s “Mad Money” host Jim Cramer, who warned Monday of a very “serious correction” in a day that saw the Dow skid 600 points on a retreat for oil and a firmer dollar, and mega-stock Apple AAPL, -5.04% (TICKER:…