Author: super@dmin

-

Why Nov. 1 is the make-or-break day for the stock market

Nov. 1 is a make-or-break day for the U.S. stock market. How so? Let’s first build the necessary background by reading “Here are the six things that could ignite a rally in the stock market” and “This money-flow chart shows that Amazon and Netflix are in dangerous territory.” Here’s a chart to get us going.…

-

The Technical Indicator: Charting a second dead-cat bounce, S&P 500 rises from 10% correction mark

Editor’s Note: This is a free edition of The Technical Indicator, a daily MarketWatch subscriber newsletter. To get this column each market day, click here. Technically speaking, the U.S. benchmarks continue to whipsaw amid broadly bearish October price action. Against this backdrop, the S&P 500 has failed a test of key resistance, miserably, as it…

-

CryptoWatch: Bitcoin steady after worst day in nearly 3 weeks

A day after suffering its biggest 24-hour decline in nearly three weeks, the bitcoin market has righted the ship early Tuesday. A single bitcoin BTCUSD, +0.40% was last changing hands at $6,272.85, up 0.1% since Monday at 5 p.m. Eastern Time on the Kraken exchange. Monday’s weakness brought the total value of all cryptocurrencies back…

-

Market Snapshot: Dow poised for slight bounce after Monday’s gut-wrenching reversal

Stock-index futures on Monday were set to open slightly higher Tuesday, a day after the Dow Jones Industrial Average staged an ugly reversal to end the session with a triple-digit loss, partly on the back of tariff worries. Comments President Donald Trump made during a late-Monday interview gave investors some hope that the president is…

-

The Moneyist: Should I use my $25,000 bonus to pay a $15,000 credit-card debt—or invest in blue chips?

Dear Moneyist, I am 27 years old and a real estate agent in New York City. Lately, I have found myself really thinking about what to do with a sum of money that’s coming in to me from a couple of real estate closings next month. For the past 2 years I have ramped up…

-

Investors beware: Merkel’s tenure may extend three more years, but she’ll be a lame duck throughout

Angela Merkel may well limp along as chancellor for the remaining three years of her mandate. But neither investors nor Germany’s European partners should take lightly the fact that she will be leaving in December the chairmanship of the conservative CDU party she has led for 13 years. Merkel announced Monday her decision to the…

-

Howard Gold's No-Nonsense Investing: If you weren’t yet worried about the stock market, you should be now

A couple of weeks ago I wrote, “If this selloff turns into a 10% decline, it would be the second such correction within eight months, which I fear would mean this nearly decade-old bull market is really in trouble.” My reasoning: This was such a rare event (over the past 30 years it has happened…

-

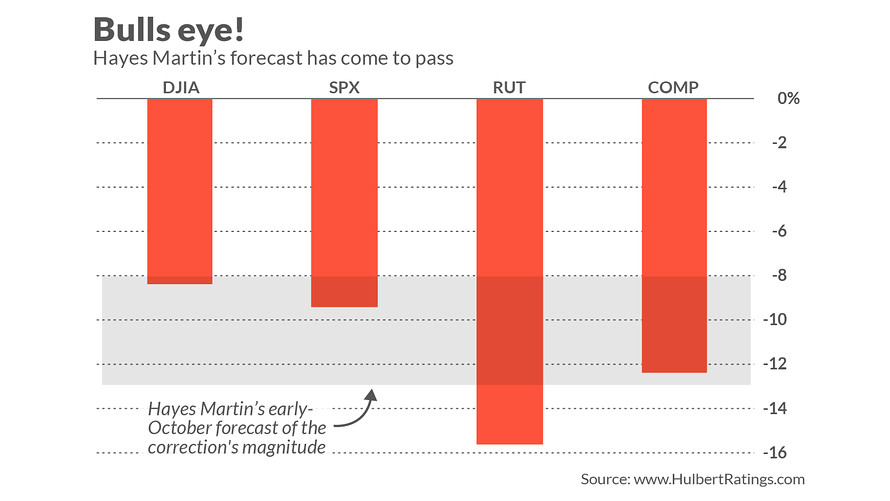

Mark Hulbert: Stock strategist who saw market correction now predicts 10% to 14% rally — and a fizzle in 2019

The bull market is still alive. That would be good news any time, but especially after Monday’s trading, when the Dow Jones Industrial Average gave up an intra-day 352-point gain to end the day with a triple-digit loss. It was the largest intra-day reversal for the Dow in more than eight months. To be sure,…

-

Currencies: Euro slides after GDP blow, dollar continues climb

Currency traders digested another blow to European market confidence on Tuesday, after a third-quarter eurozone GDP reading disappointed, while dollar traders received President Donald Trump’s assessment of a possible trade deal with China as a positive factor. For the eurozone, preliminary GDP numbers came in below expectations, adding to existing concerns about the currency bloc.…

-

Asia Markets: Asian markets mixed as U.S.-China trade tensions rear up again

Asian stock markets were mixed in early trading Tuesday, after Wall Street’s steep reversal following a report that the U.S. may impose more tariffs against Chinese goods. Japanese stocks were higher amid gains in financials following solid earnings results which helped offset losses in energy stocks. The Nikkei NIK, +0.79% was last up 0.8%.…